Eighteen months ago, the Treasurer declared the first spending surplus in more than a decade. The 2020-21 Federal budget could not have been more different – it is an unprecedented budget reflecting unprecedented times.

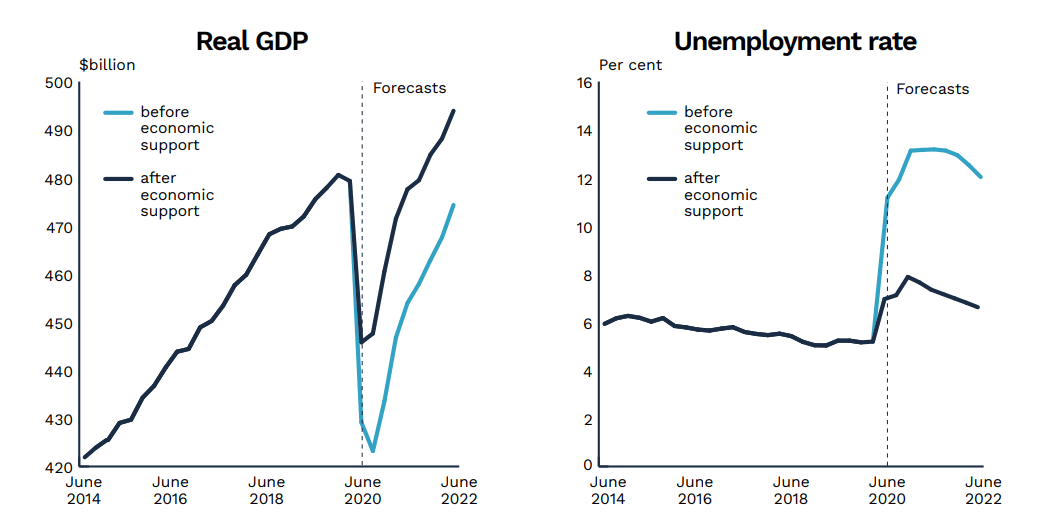

The economic impact of COVID-19 and the measures taken to support companies and individuals during the pandemic have resulted in government spending being inflated and government revenues reduced. The provisions in this budget are based on boosting our GDP and reducing unemployment.

Business Recovery and Jobs Growth

The Government has announced a range of steps to assist businesses during the recovery of COVID-19 in the form of new or improved incentives to facilitate investment and job creation opportunities and encourage employment retention.

JobMaker Hiring Credit

The Government will promote the growth of employment for those aged 35 years and under by offering new funds to companies employing additional workers. The “JobMaker Hiring Credit” was made available to qualified employers as of 7 October 2020 for each additional new job created for an eligible employee.

The JobMaker Hiring Credit will be:

- $200 per week for each eligible employee aged 16 to 29

- $100 per week for each eligible employee aged 30 to 35.

Eligibility Criteria

An employer cannot claim JobKeeper and JobMaker Hiring Credit at the same time.

To be eligible, employers must:

- hold an Australian Business number (ABN)

- be up to date with their tax lodgement obligations

- be registered for Pay as You Go (PAYG) withholding

- be reporting through Single touch payroll (STP).

To be eligible, employees must:

- be aged between 16 to 35 years

- must have worked an average of at least 20 hours a week during the quarter

- be in receipt of income support payments (such as JobSeeker Payment, Youth Allowance (Other), or Parenting Payment) for at least one of the three months before they were hired.

For more information, refer to the Federal Budget Factsheet.

Coraggio will continue to provide further information regarding eligibility criteria and how employers can register for the JobMaker Hiring Credit as it becomes available.

Instant asset write-off

After this announcement, any business with a revenue of less than $5 billion will be entitled to write off the full purchasing value of any asset purchased between 6 October 2020 and 30 June 2022.

This is projected to cover 99% of companies and a strong incentive for businesses to buy new equipment.

The initiatives are summarised as follows:

| Annual turnover less than $5 billion | Annual turnover between $50 million and $500 million | Annual turnover less than $50 million | |

| Tax Deduction | Full cost of eligible capital assets in the year of first use for:

– new depreciable assets, and – the cost of improvements to existing eligible assets. |

Full cost of eligible capital assets in the year of first use for:

– second-hand assets costing less than $150,000 |

Full cost of eligible capital assets in the year of first use for:

– new or second-hand depreciable assets, and – the cost of improvements to existing eligible assets. |

| Asset acquired from | 6 October 2020 | 6 October 2020 | 6 October 2020 |

| Asset first used or installed by | 30 June 2022 | 30 June 2021 | 30 June 2022 |

Instant asset write-off measures are welcomed, in fact they only carry forward tax deductions that would otherwise have been available in future income years. Furthermore, it is possible that Australian taxpayers who have access to these provisions will be limited to those with balance sheets that support this scale of investment.

Loss carry back measures

The Government will put in place a temporary carry-back measure to assist businesses with an aggregate turnover of less than $5 billion in temporary shocks because of the COVID-19 pandemic. The carry-back loss program, will allow businesses to opt to “carry back” the tax losses to be offset against the tax paid in the previous income year in order to generate a tax refund.

The tax refund will be made available on election for qualifying companies as they file their tax returns for 2020-21 and 2021-22. Companies will have to wait at least until they file their 2021 income tax return before they obtain the tax loss refund.

RSM, have highlighted the short and long-term advantages and disadvantages of this measure. View RSM’s Federal Budget Report Card for the same.

Cutting red-tape for businesses

The Government is committed to making it easier for companies to invest, to create jobs, to respond quickly to challenges and to exploit opportunities without having to navigate needless red tape.

The biggest reforms in Australia’s corporate insolvency regime for a decade will support companies in business and maintain Australian jobs. It is imperative to make it easier for customers and small companies to access credit by eliminating the layer red tape plays which is a key role in economic recovery.

Some of the Government’s measures are as follows –

- The Government temporarily adjusted the visa requirements to secure workers in critical sectors. This means approximately 30,000 working holiday makers and foreign students already working in key industries, such as health and aged care, supermarkets, and food manufacturing, will continue to fill labour shortages.

- By streamlining and digitising regulatory procedures, the Government makes it easier for companies to exchange carbon credits and enables faster, more effective decisions on the safety and quality of medical products.

- In the Federal budget the Government announced it would extend the scope of some of the current small business tax exemptions to companies with gross annual revenue of between $10 million and $50 million (eligible companies).

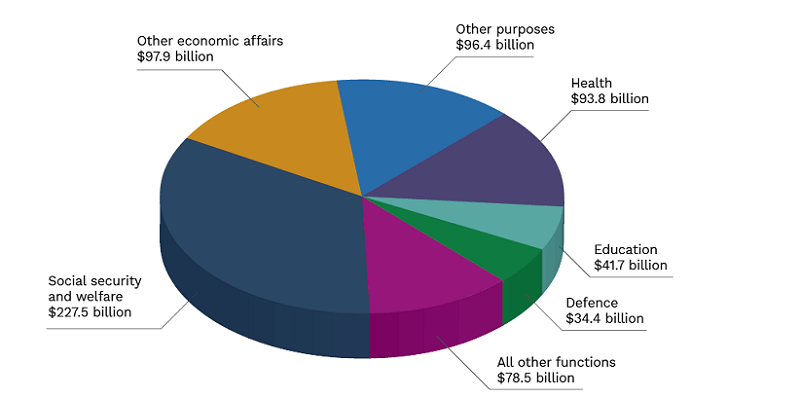

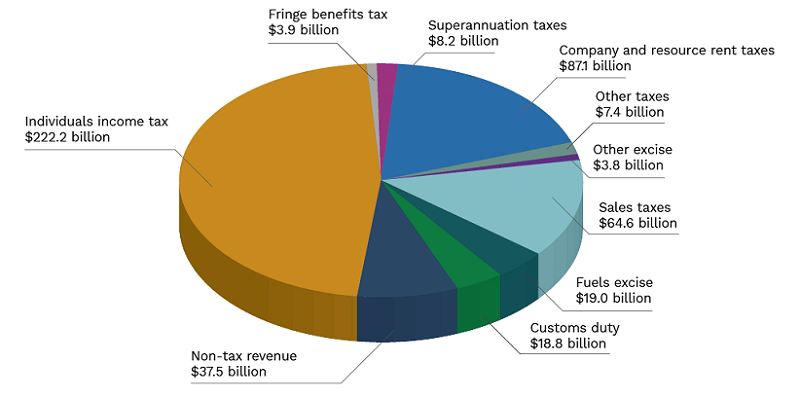

Government Revenue vs Spending Summary

Where revenue comes from (2020-21)

Where the money is spent (2020-21)

The government’s deregulation policy will continue to be pragmatic throughout the recovery period and will facilitate doing business now and in the years to come more seamlessly. These initiatives will unlock the potential of Australian enterprises by encouraging employment, growth and ongoing investment.

This article highlights the primary measures announced by the Federal Government supporting Australian private businesses. Check the full Federal Budget Report.

You can also access the below resources for more detailed information.

JobMaker – https://budget.gov.au/2020-21/content/download/glossy_jobmaker.pdf

Budget Overview – https://budget.gov.au/2020-21/content/overview.htm

COVID-19 Response – https://budget.gov.au/2020-21/content/covid-19.htm

Start a conversation with Coraggio to discuss further Budget implications.

Would you like to be a part of this?

Become an integral Member of a confidential group of business owners sharing their insights and experiences for the benefit of your business? Imagine how your business would prosper from connecting with a broader community consisting of more than 400 high performing and driven industry leaders!

Explore membership today! Find out how our proven program can assist you build a better business and become a better leader.